Fees and Billing

Consultation fees

Our receptionist will provide you with the consultation fee when you make your appointment.

Payment for the consultation is required on the day. You may pay the fee via EFTPOS or credit card. In most cases once payment is complete, we can submit your claim to Medicare on your behalf.

Surgical fees

After your consultation, if you require an operation, our staff will provide you with an itemised quote detailing the estimated costs.

Your out-of-pocket costs will depend on what type of surgery you need and what health fund you are with. Each health fund has a different fee schedule and policy for payments which our staff will explain to you. We encourage you to talk to your health fund about all costs you may incur, such as a hospital excess, before you have your operation.

Typically your out of pocket expenses could include:

- Health fund excess

- Surgical gap fee

- Anaesthetic gap fee

- Surgical assistant fee

If you are a self-insured patient, whereby you pay for the surgery yourself, you can have your procedure done by Dr Shillington as a private patient at St Andrew's Private Hospital, Ipswich. Again, our staff can provide you with a quote for this option.

What is the Medicare Benefits Schedule?

The Medicare Benefits Schedule (MBS) is a listing of how much financial assistance the government will provide to assist patients with the costs associated with health care provided by a private specialist.

What is a 'gap'?

A gap is the difference between the fee charged by your health care provider and the rebate you can claim through Medicare. For surgical procedures, your health insurance provider will also contribute some assistance to reduce the gap. The amount of assistance varies between different health insurance funds. The remainder of the gap represents an 'out of pocket' expense to the patient.

For clinic appointments (out of hospital), your health insurance provider will not financial provide assistance however Medicare rebates will still apply.

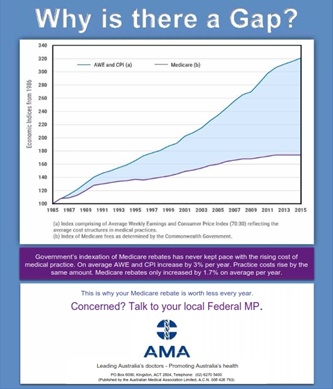

Why does a gap exist?

The Medicare Benefits Schedule (MBS) represents the amount of financial assistance the Commonwealth will provide for people undertaking health care outside of public hospitals. The amount of assistance is determined by the government, taking into account economic and budgetary constraints.

Since the development of the MBS in 1985, the Medicare schedule has not increased in line with inflation to reflect the increasing costs of health care provision. This includes sequential "Medicare Freeze" episodes, where the MBS has been indexed at 0% growth - effectively widening the gap even faster.

Health insurance funds do provide financial assistance to reduce gap expenses, however the degree of contribution is variable. For example, Australian health insurance funds at present provide no financial assistance for a doctor's consultation, unless you are admitted within a hospital. Even when a patient is admitted into a hospital, most health insurance funds will co-contribute only a small proportion of the amount allocated by Medicare - this is rarely enough to eliminate gap "out of pocket" expenses.

Department of Veteran’s Affairs (DVA)

DVA patients are required to bring their DVA card with them.